Table of Contents

Some variable annuities, nevertheless, also give a taken care of account alternative that pays a set interest rate. For functions of economic disclosure, an "property" describes an interest in residential property held in a trade or business or for financial investment or the manufacturing of revenue. OGE has determined that specific items, by their nature, are held for investment or the production of revenue, no matter of the subjective belief of the asset holder.

If you are unable to make an excellent faith price quote of the value of a possession, you may suggest on the report that the "value is not conveniently ascertainable" instead of noting a group of value. Note, nonetheless, that you usually ought to have the ability to make an excellent belief estimate of worth for running services.

A financing secured by a watercraft for personal usage is typically reportable. Companies concern bonds to elevate money.

Some bonds are safeguarded by collateral, while others, such as bonds, are backed just by the firm's excellent faith and credit scores standing. Community bonds, frequently called munis, are financial obligation obligations of states, cities, areas, or other political neighborhoods of states in the USA. The two primary types of metropolitan bonds are basic responsibility and income.

Investment Management Companies around College Station

The person that develops the account has the financial investments because account. You are not required to report assets of a profession or service, unless those rate of interests are unrelated to the procedures of business. What comprises "unassociated" will certainly vary based upon the specific situations; nonetheless, the complying with basic guidelines use: Openly traded companies: Properties of a publicly traded firm are considered to be associated with the operations of business for purposes of economic disclosure.

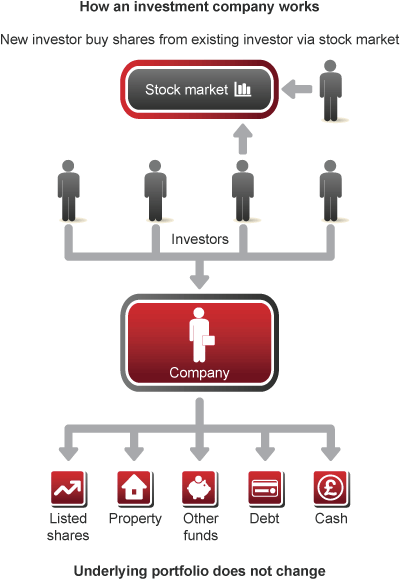

A resources commitment is a lawful right stemming from an agreement that permits a financial investment company to demand cash that an investor has actually accepted contribute. When a capitalist purchases into a financial investment fund, the financier might not have to contribute all of the money that the financier has actually vowed to provide the company that manages the financial investment fund.

When the mutual fund is prepared to acquire financial investments, the company will provide a capital call to its investors in order to raise money for the investment fund's purchases, at which time the capitalists will certainly need to contribute their promised funds to the company. Brought rate of interests are likewise called "earnings interests" and "incentive costs." For objectives of financial disclosure, a carried rate of interest is an arrangement that specifies the right to future payments based upon the performance of an investment fund or organization.

The company typically makes financial investment choices worrying the holdings of the strategy and births the risks of investment. Yearly, the staff member obtains a pay credit score that is symmetrical to a portion of the employee's wage and an income debt that is a fixed rate of return. The company defines this retirement benefit as an account equilibrium, and a cash money balance pension plan will certainly frequently allow a staff member to choose between an annuity and a lump-sum payment.

Instances of such items consist of artwork, vintage cars, antique furnishings, and rare stamps or coins. A common depend on fund of a financial institution is a trust fund that a bank takes care of in support of a team of participating customers, in order to invest and reinvest their contributions to the depend on collectively.

Investment Company servicing College Station, Texas

The name of a source of settlement may be omitted just. if that info is particularly established to be personal as a result of a fortunate relationship developed by regulation; and if the disclosure is specifically restricted: a. by law or law, b. by a guideline of a professional licensing organization, or c.

It is unusual for a filer to depend on this exception, and it is exceptionally rare for a filer to count on this exemption for greater than a few clients. Examples of scenarios that fall under among the three criteria described above consist of: the customer's identification is secured by a statute or court order or the client's identity is under seal; the customer is the subject of a pending grand jury proceeding or various other non-public investigation in which there are no public filings, statements, looks, or records that recognize the client; disclosure is restricted by a regulation of professional conduct that can be implemented by an expert licensing body; or a composed discretion arrangement, participated in as your solutions were preserved, expressly restricts disclosure of the client's identity.

The candidate has a pre-existing confidentiality contract, an IT professional would certainly not usually have a "fortunate connection established by law" with customers. The privacy contract is a relevant standard just if there is currently a blessed partnership. The term "backup charge" refers to a kind of charge arrangement in a case in which an attorney or company agrees that the repayment of legal charges will be contingent upon the effective outcome of the situation.

The specific plans for a contingency cost situation ought to be stated in a cost agreement, which is an agreement between the lawyer (or law company) and the client that describes the terms and conditions of the depiction. Co-signed financings are fundings where a legal commitment to pay has actually arised from co-signing a cosigned promissory note with an additional.

Navigation

Latest Posts

Investment Company

Investment Company

Investment Management